What is Maurice R. Greenberg's Net Worth?

Maurice R. "Hank" Greenberg is a business executive and public servant who has a net worth of $250 million. Hank Greenberg currently serves as the chairman and CEO of the global insurance and investment company C.V. Starr. Formerly, he served as the chairman and CEO of the finance and insurance corporation American International Group (AIG). Greenberg was ousted from AIG in 2005 amid an accounting scandal, for which he was subsequently charged by both the New York Attorney General and the SEC.

Peak Net Worth & Wealth Evaporation

In May 2007, Greenberg sold $42 million worth of his AIG shares. In September 2008, the United States government was forced to rescue the flailing AIG through an $85 billion bailout. The government essentially purchased an 80% stake in AIG then proceeded to sell off the company's most valuable assets. Hank Greenberg owned 13 million shares in the insurance giant. At the peak of AIG's success in December 2007, those shares were worth $1.1 billion. At the time the government bailed out AIG, his stake was worth just $25 million. In January 2010, Greenberg offloaded his entire remaining stake in AIG to Swiss bank UBS for $278 million. He also subsequently had to pay $9 million to settle a civil case brought by the NY Attorney General and $15 million in penalties to settle charges from the Securities Exchange Commission.

Early Life and Education

Maurice R. Greenberg was born on May 4, 1925 in New York City to Jewish parents Ada and Jacob. His mother remarried after his father's passing in the early 1930s. During World War II, Greenberg served in the US Army, participating in Operation Overlord and the liberation of Dachau. He later served during the Korean War. For his higher education, Greenberg attended the University of Miami, from which he earned his bachelor's degree in 1948. He went on to obtain an undergraduate law degree from New York Law School in 1950. Although he was admitted to the New York Bar in 1953, Greenberg did not practice law.

American International Group

In 1962, Greenberg became head of North American holdings at the finance and insurance corporation American International Group, having been appointed by AIG's founder Cornelius Vander Starr. Greenberg was officially chosen to succeed Starr as chairman and CEO in 1968, and the following year, AIG went public. The corporation expanded significantly during the 1970s as it introduced specialized energy, transportation, and shipping products. AIG continued to grow over the ensuing decades, until an accounting scandal in 2005 dented its reputation. Amid a series of fraud investigations conducted by the SEC, the US Department of Justice, and the New York State Attorney General's Office, Greenberg was ousted from AIG.

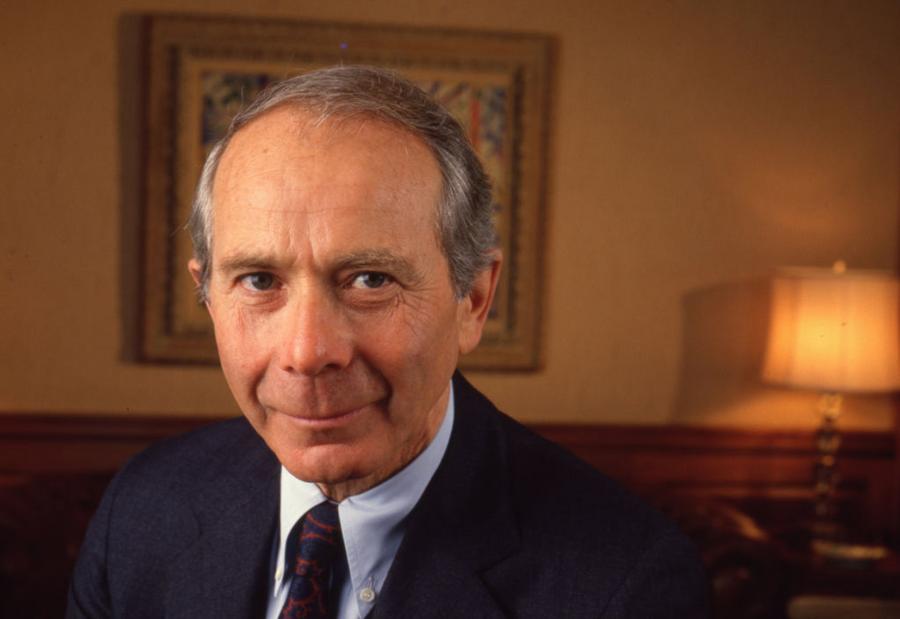

Maurice R. Greenberg in 1986 (Photo by Rob Kinmonth/Getty Images)

C.V. Starr

In 1960, Greenberg became vice president of the global insurance and investment company C.V. Starr, which was founded by AIG founder Cornelius Vander Starr. He went on to be elected director of C.V. Starr in 1965, and chairman and CEO of the company in 1968. Greenberg is also the chairman of the board and managing director of Starr International. Under his leadership, Starr has invested over $1 billion in China since 2005.

Legal Problems

Greenberg has dealt with legal problems related to alleged fraudulent business practices. In 2005, after the AIG accounting scandal, he was dealt civil fraud charges by the New York Attorney General for inflating AIG's finances. Later, in 2009, Greenberg was charged with fraud by the SEC for the same scandal. He ended up agreeing to pay $15 million in penalties for the charges. For the civil case, which came to trial in 2016, Greenberg agreed to pay $9 million.

Getty Images

Public Positions

Greenberg has held a number of international public positions throughout his career. In 1990, due to his ties with China, he was appointed by Shanghai mayor Zhu Rongji as the first chairman of the International Business Leaders' Advisory Council for the Mayor of Shanghai. Four years later, Greenberg was appointed senior economic advisor to the government of Beijing. From 1998 to 2005, he served as a member of the Hong Kong Chief Executive's Council of International Advisers. Greenberg's other public positions have included spots on the advisory board of the Tsinghua School of Economics and Management; the board of directors of the National Committee on United States-China Relations; and the steering committee of the China-United States Exchange Foundation. He is also the founding chairman of the US-Philippine Business Committee and chairman of the US-Korea Business Council.

In the United States, Greenberg formerly served as vice chairman and director of the Council on Foreign Relations. He is also a former chairman of the Asia Society; a former chairman of the National Interest; a chairman emeritus of the board of trustees of New York-Presbyterian Hospital; and chairman of the Academic Medicine Development Company Foundation. Meanwhile, Greenberg sits on the boards of such organizations as the Peterson Institute for International Economics, Weill Cornell Medicine, the Manhattan Institute for Policy Research, and the International Rescue Committee.

Political Activity

A Republican, Greenberg has donated to such Republican presidential candidates as Mitt Romney and Jeb Bush. He also donated to a Super PAC supporting the presidential campaign of Marco Rubio in 2016.

Personal Life

With his wife Corinne Zuckerman, whom he married in 1950, Greenberg has four children: Jeffrey, Evan, L. Scott, and Cathleen. The first three became businesspeople, while Cathleen became a physician.

Bengali (BD) ·

Bengali (BD) ·  English (US) ·

English (US) ·